When did the price spike occur and how bad was it?

Prices were at abnormally high levels from Saturday February 13 through Friday February 19. In our market, natural gas has been trading at less than $3 per MMBtu all winter; on President’s Day Weekend it traded at $235. This is an increase of 7800%!What caused the price spike?

There was a significant gap between supply and demand, both driven by extremely cold temperatures, especially in the southern part of the country. Natural gas wells in Texas and Oklahoma, where much of the natural gas supply comes from, froze up and could not deliver natural gas to the system. At the same time, customers required more natural gas than normal to heat homes and businesses.Doesn’t OPU buy its gas ahead of time (hedge) to protect against price spikes?

OPU does hedge much of its gas by purchasing ahead of time. Because the volume of gas that OPU’s customers use varies greatly dependent on the temperature, a portion of our gas requirements must be purchased on the daily markets. Under normal conditions, the average cost of the hedged gas and daily purchased gas averages out to a fairly stable price.What does this mean for my gas bill?

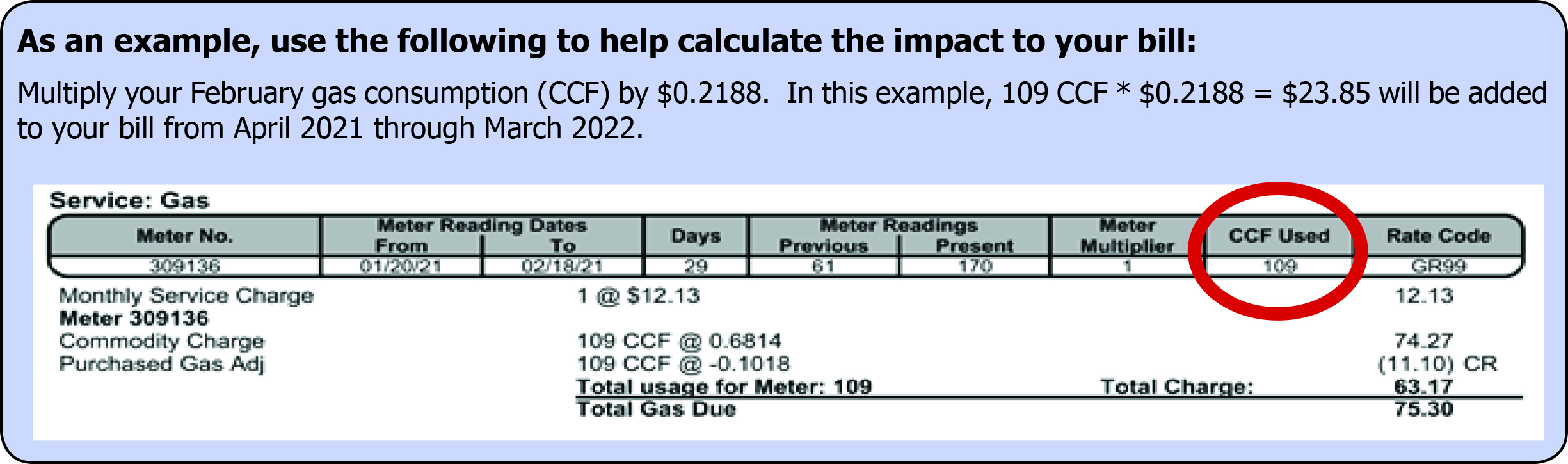

The average residential customer’s annual natural gas bill is $600. The additional cost of the February natural gas is approximately $350 which is 68% of the annual bill. This will be spread out over 12 months beginning in April. The average residential customer will have approximately $30 added to their bill.

Is there assistance available if I can’t afford to pay my bill?

There is LIHEAP (Low-Income Heating Energy Assistance Program) money available to assist those struggling to pay their heating bills.Contact SEMCAC at 1-800-944-3281 for more information.

You may also contact our customer service department for assistance setting up payment arrangements or they can point you in the right direction to receive other financial heating assistance.

Why doesn’t OPU just absorb the additional cost?

OPU is a not-for-profit company. All costs are ultimately paid for by our customers whether it is through a cost-recovery charge or through increasing base rates.Will OPU raise its rates because of this?

No, OPU plans to recover the additional cost through its PGA and a special charge which will collect the money from customers over a one-year period, based on their consumption in February.What is the PGA?

PGA is the Purchased Gas Adjustment. It is the line item on your bill which passes back to the customer the difference between the actual cost of gas and the cost that is assumed within our base rate. The PGA adds to your bill when gas prices are higher and subtracts from your bill when gas prices are lower. For most months over the past three years it has lowered gas bills because of historically low gas pricing.Does OPU make a profit from this additional costs?

OPU passes through the commodity cost and does not mark up a profit. OPU does have a margin for operational expenses built into the base rate and is not influenced by the actual cost of the natural gas provided.I heard in the news that customers won’t feel the effect of this until September; why is OPU saying I will see it on my April bill?

The story you heard was most likely referring to the large investor-owned utilities who are regulated by the Minnesota Public Utilities Commission. Those utilities have an annual “true-up” which goes into effect in September and spreads out the difference in gas cost over the next 12 months.Will my electricity prices also be affected?

No, although, the wholesale price of electricity increased during the event, our wholesale provider, SMMPA, was able to protect us from the high costs by running generation that was fueled by coal and diesel.Has this happened before?

While significant price spikes have occurred previously, none of them have been close to this magnitude. (See Chart on back)How can a natural gas well-head “freeze off”?

When natural gas comes out of the ground, it is “wet” meaning it contains other hydrocarbons that are heavier than natural gas; some of these compounds are liquids and can gel. Additionally, water is used in the fracking process and some of this water comes up with the natural gas. The gas is processed so the unwanted components are removed before it goes into the pipeline for transportation. While gas wells in northern climates are insulated to avoid freezing, many of those in the south were not.How much of the price spike was due to speculators just trying to make money?

There are no indications that speculation was a factor in the price run up. Speculators typically trade gas futures rather than physical gas. The market run up was in the daily, physical gas market and was due to significantly increased demand and reduced supply.Are there going to be any investigations into the market?

At the state level, the Minnesota Public Utilities Commission has ordered an investigation. At the federal level, FERC (Federal Energy Regulatory Commission) announced it will be examining the wholesale natural gas market activity which occurred during the event. FERC will seek to uncover market manipulation or other anti-competitive actions that may have occurred. Additionally, Minnesota Senator Tina Smith has called on the U.S. Department of Energy to open an investigation into whether price spikes were the result of price gouging and to find solutions to make sure it doesn’t happen again.Why isn’t the gas market regulated?

The production side of the natural gas industry was deregulated in the 1980s in response to a natural gas shortage. Prior to deregulation, pipeline companies both sold and transported natural gas to local distribution companies like OPU. With deregulation, pipeline companies became transportation companies, and the number of gas suppliers increased dramatically. This increased competition drove innovation leading to abundant supply and inexpensive natural gas.Were we in danger of not having gas delivered?

All utilities in Minnesota were able to obtain the gas required to serve their customers, and the natural gas infrastructure in Minnesota remained robust throughout the event.Is there a shortage of natural gas?

There is an abundant supply of natural gas. The reduction in supply was a temporary situation. Once natural gas began flowing from the wells again, the price quickly returned to pre-spike levels.